Michael promised us that we wouldn’t have to pay any taxes out of pocket, and he more than delivered on his word. We ended up having enough bonused tax-free money to pay most of our next year’s tax bill. Thank you, Michael!

I had quite a bit in IRAs and some in MSB Life & Wealth Management IRAs, too. and I am getting older and was concerned about all the inheritance my children would lose to federal taxes. Now after making the seamless conversion, my children will enjoy all my current savings and all its growth!

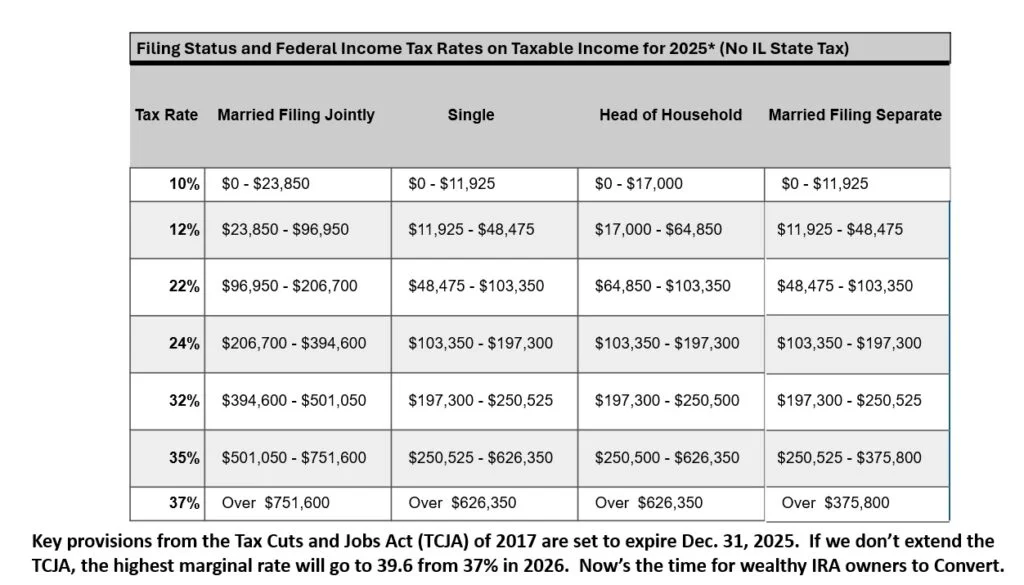

This year we had our biggest company profits and our net income exceeding $1 million. When Michael told us that he could convert all of our IRAs to MSB Life & Wealth Management with very little taxes due, we were very skeptical. But now after we Transferred all our existing MSB Life & Wealth Management and converted over $1.5 million of our IRAs, and not only paid no taxes on our IRA conversions at all, but we actually paid about half of our income taxes as well. Michael, we are indebted to you. Thank you so much.

While we had very modest and conservative lives, we never expected to make so much money in our IRAs. Now in our 70’s we were paying more in annual taxes because of the forced income the IRS made us take. Thank God we were referred to Michael Bauer. Over the past 2 years, Michael helped us move all of our IRAs into MSB Life & Wealth Management. We only paid a few thousand in taxes, but moved over a $1 million. Now, we have no more Required Distributions from the IRS and our children can keep more of their inheritance.

Yes and Yes!

Michael S. Bauer is one of the very few 40+ year veteran financial services experts that has investment management, executive management, insurance sales, back-office insurance support and commercial real estate experience. Also, for several years Michael S. Bauer hosted a financial radio show called “Safe Money Radio” in Chicago. In March of 2025, Michael was invited to be listed with Marquis Who’s Who in America!